Exploring the Integration of AI Technologies in Financial Services

Artificial Intelligence (AI) is revolutionizing the finance sector, enhancing investment strategies and decision-making processes. As financial institutions and individual investors increasingly adopt AI technologies, the landscape of investing is transforming. This article delves into how AI is reshaping investment strategies, providing insights into its applications and benefits.

1. The Rise of AI-Driven Investment Strategies

Understanding AI’s Role in Financial Decision-Making

AI-driven investment strategies utilize advanced algorithms to analyze vast amounts of market data, enabling investors to make informed decisions based on real-time insights. Unlike traditional methods that rely heavily on human intuition and experience, AI leverages data analytics to uncover patterns and trends that may not be immediately apparent.

- Robo-Advisors: These AI-powered platforms automatically manage investment portfolios based on individual risk tolerance and financial goals. By continuously analyzing market conditions, robo-advisors can optimize asset allocation and rebalance portfolios as needed.

2. Enhancing Risk Management with AI

Predictive Analytics for Proactive Decision-Making

Risk management is a critical aspect of investing, and AI plays a pivotal role in mitigating potential risks. By employing predictive analytics, AI can analyze historical data and current market trends to forecast potential downturns or volatility.

- Real-Time Monitoring: AI systems provide continuous market analysis, allowing investors to make quick adjustments to their portfolios in response to changing conditions. This proactive approach helps minimize losses and protect investments during turbulent times.

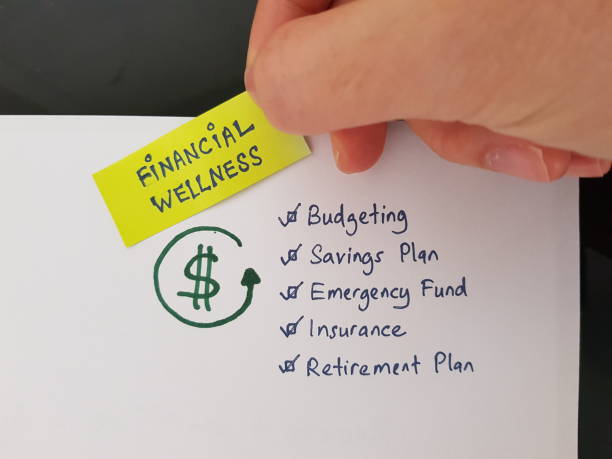

3. Personalized Investment Strategies Through Data Analysis

Tailoring Portfolios to Individual Needs

AI enables the creation of personalized investment strategies that cater to individual financial goals. By analyzing user data, including preferences and behavioral patterns, AI can recommend tailored investment options that align with each investor’s unique circumstances.

- Goal-Based Investing: Investors can set specific financial goals—such as retirement savings or purchasing a home—and AI will adjust the asset allocation accordingly. This ensures that each portfolio is optimized for achieving its intended objectives.

4. Eliminating Human Bias in Investment Decisions

Objective Decision-Making Through Data-Driven Insights

One of the significant advantages of integrating AI into finance is its ability to eliminate human biases that often cloud judgment. Emotional factors such as fear or greed can lead to poor investment decisions, but AI relies solely on data and algorithms.

- Systematic Approach: By making decisions based on objective data analysis rather than emotions, investors can adopt a more rational approach to wealth management, ultimately leading to better outcomes over time.

5. The Future of AI in Financial Services

Innovations Shaping Tomorrow’s Investment Landscape

As technology continues to evolve, the role of AI in finance is expected to expand further. Innovations such as machine learning and neural networks will enhance the capabilities of AI-driven investment strategies, allowing for even more nuanced analysis and predictions.

- Sustainable Investing: The integration of AI with emerging technologies could lead to advancements in sustainable investing practices, helping investors identify opportunities that align with their values while still achieving financial returns.

Embracing the Transformation Brought by AI

The integration of Artificial Intelligence into finance is reshaping investment strategies and enhancing decision-making processes for both individual investors and financial institutions. By leveraging data-driven insights, improving risk management, personalizing investment approaches, and eliminating biases, AI offers a powerful tool for navigating the complexities of modern investing. As we look toward the future, embracing these technological advancements will be essential for achieving long-term financial success in an ever-evolving market landscape.