Understanding the Importance of Innovative Financing

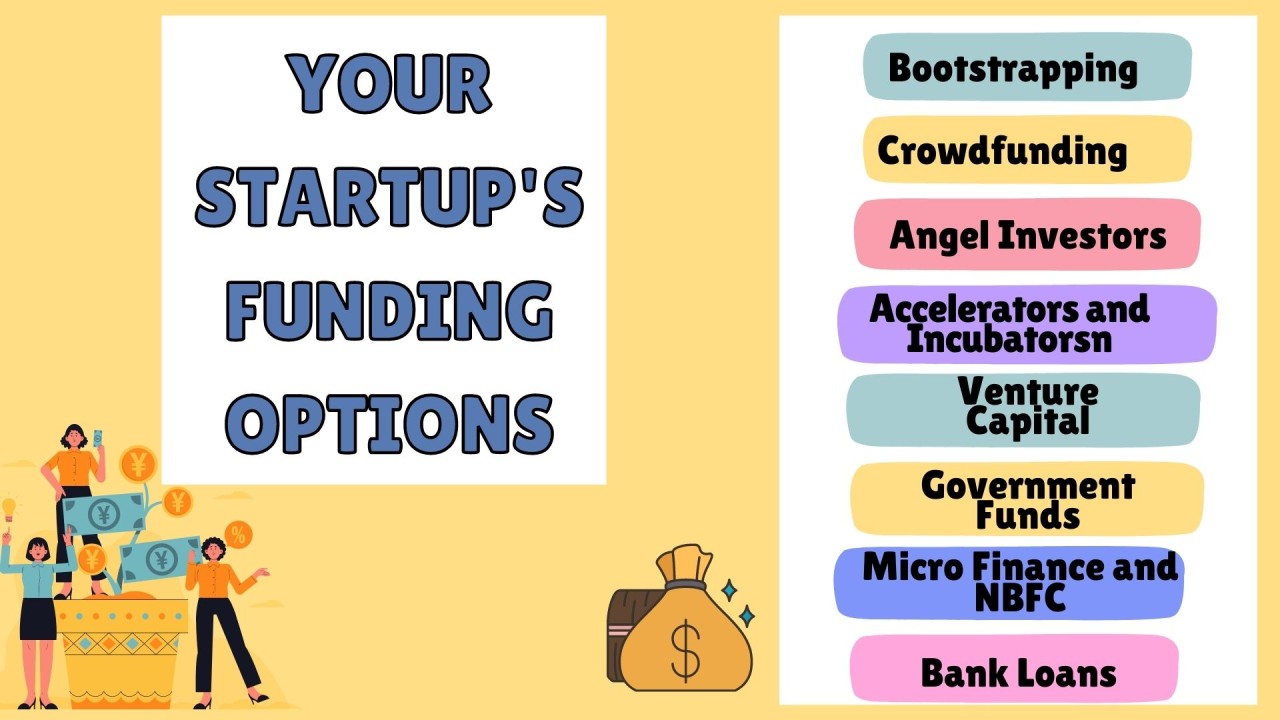

Securing funding is one of the most significant challenges faced by startups. Innovative financing options, such as crowdfunding, peer-to-peer lending, and venture capital, provide entrepreneurs with diverse avenues to obtain the necessary funds for growth. This article explores these financing methods and highlights their importance in helping startups thrive.

Why Innovative Financing Matters for Startups

In a competitive landscape, traditional funding routes may not suffice for many startups. Innovative financing options allow entrepreneurs to tap into new sources of capital while fostering community engagement and support. By exploring these alternatives, startups can enhance their financial stability and accelerate growth.Key Benefits of Innovative Financing:

- Access to Capital: Diverse funding sources can provide essential financial support.

- Community Engagement: Crowdfunding allows startups to build a loyal customer base from the outset.

Crowdfunding: Engaging the Public for Financial Support

What is Crowdfunding?

Crowdfunding is a method that enables startups to raise small amounts of money from a large number of people, typically via online platforms. This approach democratizes investment opportunities and allows entrepreneurs to present their ideas directly to potential backers.Types of Crowdfunding:

- Reward-Based Crowdfunding: Backers receive a product or service in return for their investment.

- Equity Crowdfunding: Investors receive equity in the company in exchange for their contributions.

Successful Examples of Crowdfunding

Many successful companies have utilized crowdfunding to launch their products. For instance, BrewDog raised over £26 million through its Equity for Punks campaign, demonstrating how crowdfunding can foster community loyalty while securing vital funds.

Peer-to-Peer Lending: Connecting Borrowers with Investors

Understanding Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect startups with individual investors willing to fund loans. This model allows businesses to access capital without going through traditional banks, often resulting in more competitive interest rates.Benefits of Peer-to-Peer Lending:

- Faster Funding: P2P lending can provide quicker access to funds compared to traditional loans.

- Flexible Terms: Borrowers may find more favorable terms tailored to their needs.

Popular P2P Lending Platforms

Platforms like Funding Circle and Lending Club facilitate P2P lending, allowing startups to present their business plans directly to potential investors. This approach not only provides funding but also helps build relationships with individuals who are interested in supporting new ventures.

Venture Capital: Fueling High-Growth Startups

What is Venture Capital?

Venture capital (VC) involves investment firms or individuals providing funding to startups with high growth potential in exchange for equity. This method is particularly suited for technology-driven sectors that require substantial capital for rapid expansion.Advantages of Venture Capital:

- Substantial Funding: VC firms can offer large sums of money compared to other financing options.

- Expertise and Guidance: Many VCs provide mentorship and strategic advice, helping startups navigate challenges.

The Role of Venture Capital in Startup Growth

Successful examples include companies like Blue Apron, which secured $20 million in venture debt to expand operations without diluting equity. This type of financing enables startups to preserve ownership while accessing necessary funds for growth.

Innovative Financing for Startup Success

Innovative financing options like crowdfunding, peer-to-peer lending, and venture capital are essential tools for startups seeking financial support. By understanding these alternatives and leveraging them effectively, entrepreneurs can secure the necessary funds for growth while building strong relationships with their communities and investors. As the startup landscape continues to evolve, embracing these innovative financing strategies will be crucial for long-term success.